Save with federal

incentives

New federal legislation is eliminating energy-efficiency tax credits early. The deadline to complete eligible efficiency upgrades and claim your tax credits is fast approaching on December 31, 2025. Schedule your no-cost Home Energy Assessment today to secure your savings before it’s too late.

What Is the Inflation Reduction Act?

The Inflation Reduction Act, also called the IRA, was signed into law in August 2022. It is the most significant climate investment yet made by the federal government, with the goal of reducing greenhouse gas emissions by 40% in the U.S. by 2030. The IRA includes grants, rebates, and tax credits to encourage energy savings.

What Incentives Are Available for My Home Today?

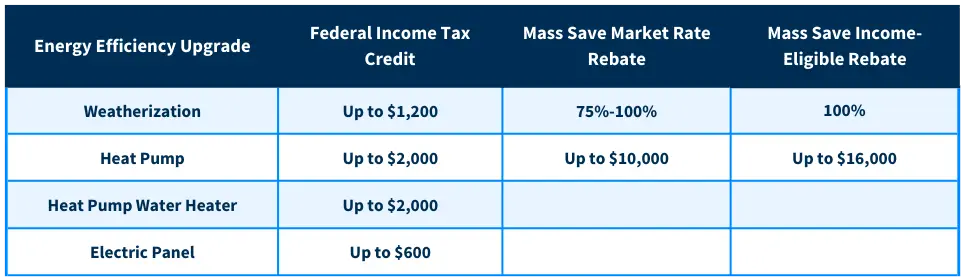

Mass Save® rebates and incentives aren’t going anywhere. As an added carrot for Massachusetts residents, IRA federal incentives went into effect in January 2023 to further encourage emission reductions and help make home energy efficiency achievable for everyone.

For more information, contact your tax professional.

What’s Included in the IRA for Homeowners?

The Homeowner Managing Energy Savings (HOMES) Rebate Program

The $4.3 billion in performance-based, whole-home rebates is geared toward air sealing, insulation, appliances, and HVAC for single- and multi-family homes at all income levels.

The High-Efficiency Electric Home Rebate Act (HEERA)

The $4.5 billion is to fund the electrification of low- and moderate-income households. Rebates include heat pumps, heat pump water heaters, and rooftop solar.

Energy Efficiency Home Improvement Credit (25C)

Starting in January of 2023, households can deduct 30% of the cost of upgrades like heat pumps and insulation upgrades, with the annual limit resetting every year.

Get Your Incentives Now

See how much you can save! Call us at (781) 305-3319 to schedule your home upgrades or book a no-cost Heating & Cooling Consultation to learn more about heat pumps.

Haven’t had a no-cost Mass Save Home Energy Assessment yet? We can help with that, too!